Business Insurance in and around Laurel

Calling all small business owners of Laurel!

Cover all the bases for your small business

Coverage With State Farm Can Help Your Small Business.

Do you feel overwhelmed when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Debbie Murphy help you learn about excellent business insurance.

Calling all small business owners of Laurel!

Cover all the bases for your small business

Cover Your Business Assets

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is closed down. It not only protects your income, but also helps with regular payroll expenditures. You can also include liability, which is critical coverage protecting your financial assets in the event of a claim or judgment against you by a third party.

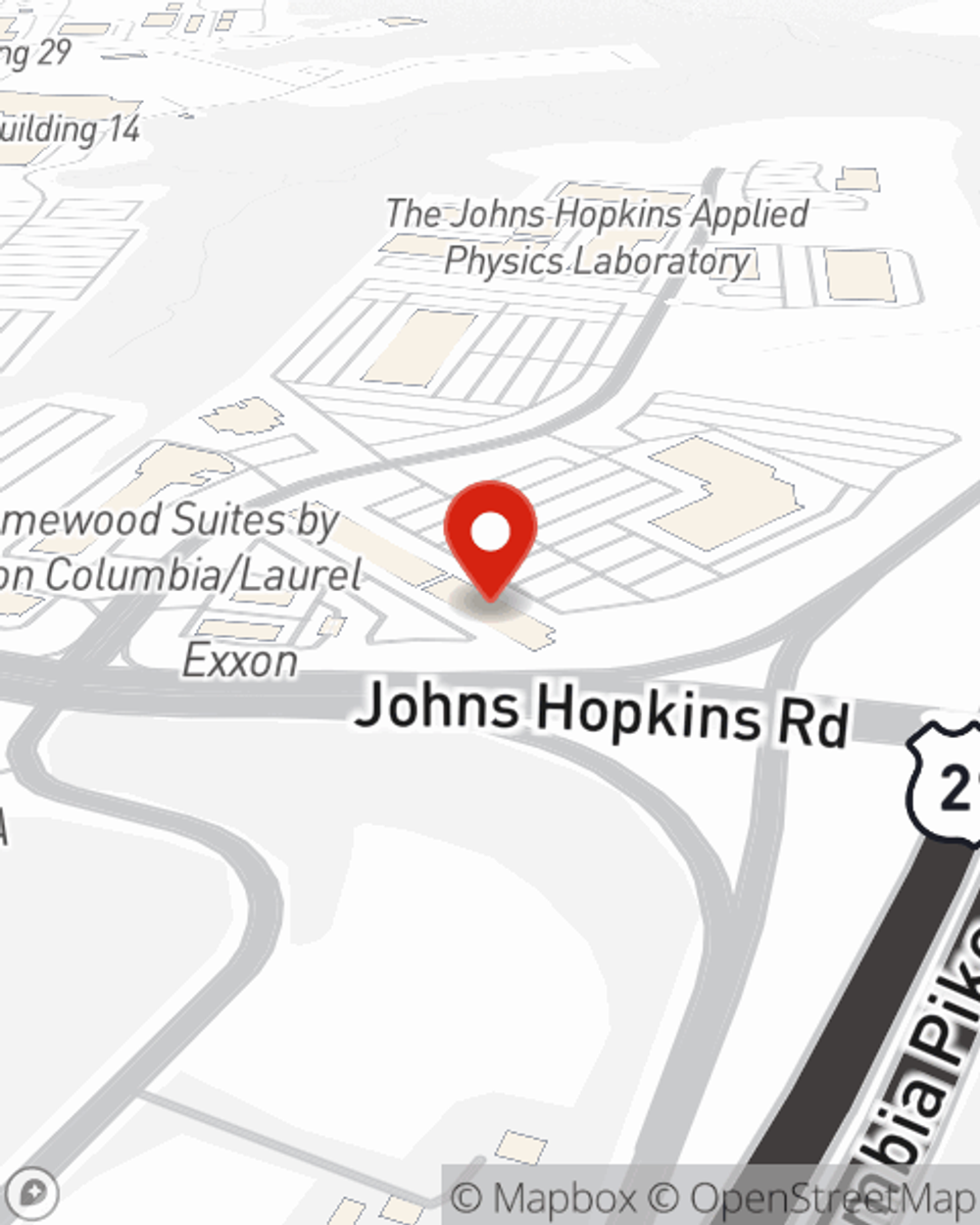

Get in touch with State Farm agent Debbie Murphy today to discover how the trusted name for small business insurance can ease your worries about the future here in Laurel, MD.

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Debbie Murphy

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.